Introduction

If you’ve ever tried to make an online purchase while using a VPN, you may have encountered a frustrating scenario: your payment gets rejected. Sometimes the website claims your card details are incorrect. Other times, you receive a vague error message about payment processing issues. But your card works fine—the real culprit is that the merchant is blocking VPN traffic.

This practice, while intended to prevent fraud, is actually counterproductive in today’s digital landscape. Here’s why your business should stop blocking VPN payments immediately.

(Note: At Zero2Webmaster, we use and recommend ExpressVPN for secure browsing and protection on public networks.)

Modern payment security doesn’t require blocking VPN users.

The Privacy Paradox: Punishing Security-Conscious Customers

Virtual Private Networks (VPNs) have become essential tools for online privacy and security. Millions of legitimate customers use VPNs daily to:

- Protect their data on public WiFi networks

- Maintain privacy from ISP tracking

- Secure their browsing activity

- Comply with corporate security policies

- Access services while traveling internationally

When you block VPN users from making payments, you’re essentially penalizing your most security-conscious customers—the very people who are taking responsible steps to protect their financial information online.

VPN users are protecting themselves on public networks.

The Traveler’s Dilemma: Your Best Customers Can’t Check Out

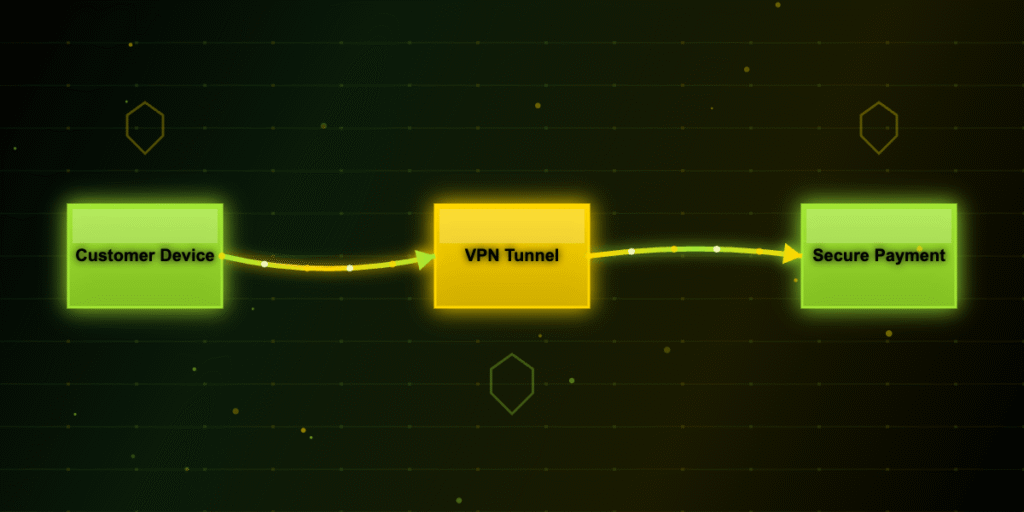

Business travelers and vacationers face a particularly acute problem. These customers rely heavily on public WiFi in hotels, airports, coffee shops, and co-working spaces—exactly the environments where VPNs are most critical for security.

Public WiFi networks are hunting grounds for cybercriminals. Without a VPN, travelers risk:

- Man-in-the-middle attacks that intercept payment data

- Session hijacking that compromises accounts

- Packet sniffing that captures sensitive information

- Evil twin networks that impersonate legitimate hotspots

By blocking VPN payments, you’re forcing travelers to choose between making a purchase and maintaining their cybersecurity. Many will simply abandon their cart and shop with a competitor who doesn’t impose this restriction.

The False Sense of Security: VPN Blocking Doesn’t Stop Fraud

Payment fraud is a legitimate concern for online merchants, but blocking VPNs is an ineffective and outdated approach to fraud prevention. Here’s why:

While some low-level fraud attempts may use VPNs, sophisticated fraudsters typically rely on residential proxies, compromised devices, and other advanced methods that easily bypass consumer VPN detection.

Legitimate fraud prevention doesn’t require blocking VPNs. Modern payment processors use sophisticated algorithms that analyze dozens of signals—device fingerprinting, behavioral analytics, transaction patterns, billing address verification, and more. These methods are far more effective than crude IP-based blocking.

You’re creating more false positives than catching fraud. For every fraudulent transaction you might prevent, you’re likely rejecting hundreds or thousands of legitimate purchases from VPN users.

Rejecting valid cards being used by real customers is a sure way to reduce your company’s revenues.

The Customer Experience Nightmare

When you block VPN payments without clear communication, you create a terrible user experience:

- Customers waste time entering payment information that will inevitably fail

- Error messages are often misleading (“Your card was declined” when the card is fine)

- There’s no clear explanation of the actual problem

- Customers feel frustrated, confused, and distrusted

- Cart abandonment rates skyrocket

- Brand reputation suffers

Even worse, many customers won’t realize the VPN is the issue. They’ll assume your payment system is broken, their card has a problem, or your business is somehow unreliable. Either way, they’re unlikely to complete the purchase or return in the future.

The Business Case: Lost Revenue and Competitive Disadvantage

Let’s talk bottom line. Blocking VPN users means:

- Lost sales: Every rejected transaction is revenue you’ll never recover

- Higher customer acquisition costs: You’ve paid to attract these visitors, only to turn them away at checkout

- Reduced customer lifetime value: First-time buyers who face VPN blocks won’t become repeat customers

- Competitive disadvantage: Businesses that accept VPN payments will capture market share you’re leaving on the table

- Negative word-of-mouth: Frustrated customers share their bad experiences online and with friends

Modern Solutions: How to Accept VPN Payments Safely

The good news is that you don’t have to choose between security and serving VPN users. Modern payment processing solutions offer robust fraud prevention without blanket VPN blocking.

Why Stripe is One of the Best Payment Processors

Stripe has become a gold standard for online payments, and for good reason:

Advanced fraud detection without VPN discrimination: Stripe Radar uses machine learning to analyze hundreds of signals per transaction, identifying genuine fraud without rejecting legitimate VPN users.

Adaptive authentication: 3D Secure and other verification methods step up security when needed, rather than blocking payments outright.

Global support: Stripe handles international transactions seamlessly, essential for businesses serving travelers and international customers.

Developer-friendly integration: Whether you’re running an e-commerce store, accepting donations for a nonprofit, or processing subscriptions, Stripe integrates cleanly with virtually any platform.

Transparent pricing: No hidden fees, no monthly minimums, just straightforward per-transaction pricing.

Excellent documentation and support: Getting up and running is straightforward, and troubleshooting is well-supported.

Stripe’s advanced fraud detection works seamlessly with VPN connections.

Best Practices for Payment Security Without VPN Blocking

Here’s how modern businesses should approach payment security:

- Use a sophisticated payment processor like Stripe that employs multi-factor fraud detection

- Leverage Stripe Radar’s machine learning to automatically detect and block fraudulent transactions

- Enable address verification (AVS) and CVV checks built into Stripe

- Use 3D Secure authentication for high-risk transactions (Stripe handles this automatically)

- Ensure your website has SSL encryption to secure all data transmitted between customers and your site

- Implement Cloudflare‘s free site protections including DDoS protection and firewall rules, with optional paid upgrades for bot management

- Let Stripe’s risk engine analyze transaction patterns and flag suspicious activity

- Work with experienced developers who can properly integrate these security features into your website

Setting Up Modern Payment Processing the Right Way

Whether you’re launching a new e-commerce store, adding a donation system to your nonprofit website, or upgrading your existing payment infrastructure, the right setup makes all the difference.

How Zero2Webmaster Can Help

At Zero2Webmaster, we specialize in implementing secure, user-friendly payment solutions that don’t compromise your customers’ privacy or your security. We can help you:

- Integrate Stripe payment processing into your existing WordPress website or build a new site from scratch

- Set up donation systems for nonprofits with recurring giving options and automated thank-you emails

- Build WordPress-based online stores with product catalogs, inventory management, and seamless checkout experiences

- Configure Stripe’s fraud prevention features to protect your business without blocking legitimate customers

- Set up SSL encryption and Cloudflare protection through Rocket.net, the hosting service we use ourselves and recommend to all our clients

- Create optimized checkout flows to maximize conversion rates and minimize cart abandonment

Our WordPress-based payment solutions work seamlessly whether your customers are shopping from home, browsing on their phone, or making purchases while traveling internationally—VPN or no VPN. Stripe handles all payment processing securely, and the Rocket.net hosting we use includes Cloudflare Enterprise integration by default, ensuring world-class speed, security, and caching for your website.

Serve customers worldwide without discriminating against VPN users

The Bottom Line

Blocking VPN payments reflects an outdated approach to online security. It punishes your most security-conscious customers, discriminates against travelers who need VPNs most, provides minimal actual fraud prevention, and costs you revenue.

Modern payment processing solutions like Stripe offer sophisticated fraud detection that protects your business without creating artificial barriers to legitimate purchases. Of course, businesses must still comply with regional financial regulations—VPN users connecting from sanctioned countries may need to be restricted—but for legitimate customers, VPN blocking is counterproductive. By embracing modern security tools, you can serve all your customers—including the growing number who use VPNs for privacy and security—while actually improving your fraud prevention.

Your customers are trying to give you money. Don’t let outdated payment policies stand in their way.

And if you’re looking for a reliable VPN to protect your own online activities and transactions, we use and recommend ExpressVPN.

Disclosure: Zero2Webmaster earns a small commission if you purchase through our ExpressVPN link. You’ll get 30 free days of service, and your support helps fund our educational articles and keeps our servers running.

Ready to modernize your payment processing? Contact Zero2Webmaster today to set up Stripe integration, build an e-commerce solution that welcomes all customers, or upgrade your nonprofit’s donation system. Let’s create a checkout experience that’s secure, private, and profitable.

Keywords: VPN payment blocking, e-commerce security, Stripe payment processing, online payment solutions, VPN discrimination, payment fraud prevention, secure checkout, nonprofit donations, e-commerce integration